The Weset white paper remains a strong foundation for understanding the mission, technology, and tokenization strategy behind $WECO. However, with recent advancements, including the integration of an AI agent and the expansion to Base Network, it is important to supplement the original document with updated insights. This addendum outlines how these new developments enhance Weset’s capabilities and long-term vision.

Weset is now integrating AI to optimize and streamline real-world asset (RWA) tokenization. The AI agent serves as a critical component in making asset digitization more accessible, secure, and scalable.

While the AI agent is still in development, potential ways for users to interact with it include:

The following are potential scenarios but the Agent is noy bound by the possibilities below.

Weset has strategically expanded $WECO to Base Network to leverage its efficiency, scalability, and integration with the Virtuals Protocol. The transition enhances liquidity, trading accessibility, and network growth.

The RWA Platform Token: $WECO on BNB Chain remains the primary token for Weset’s real-world asset (RWA) platform, including marketplace transactions, dashboard payouts, and ecosystem rewards. While $WECO on Base focuses on expanding AI integrations and liquidity, $WECO on BNB continues to serve as the foundation for tokenized asset operations and enterprise adoption.

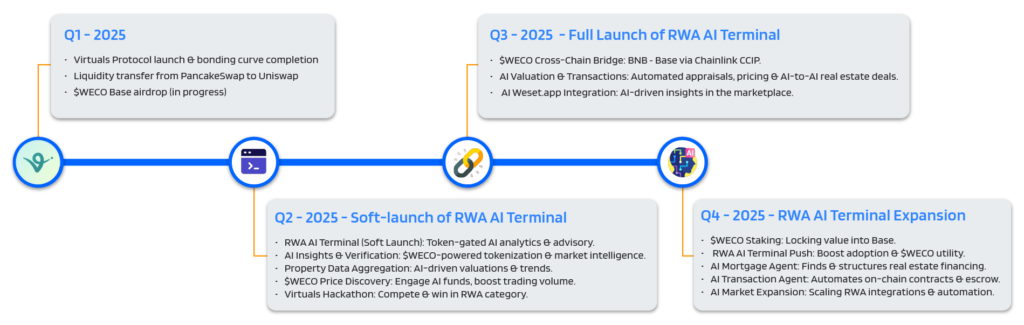

The next phases of Weset’s growth are designed to be bold, ambitious, and adaptive—driving AI evolution, DeFi expansion, and cross-chain integration. While this roadmap outlines our core milestones, flexibility is key; we will remain opportunistic, responsive to market conditions, and open to strategic pivots that maximize long-term success.

✅ Successful launch on Virtuals Protocol, with the bonding curve fully completed in just 10 days.

✅ Liquidity transitioned from PancakeSwap (BNB) to Uniswap (Base Network).

✅ AI Agent Initial Deployment: Core functionalities activated, gathering user interaction data for optimization.

🔄 Community Growth Initiative: $WECO airdrop structured to incentivize organic growth on X (Twitter) and Telegram.

🔄 $WECO Airdrop Execution: Structured distribution to reward engaged community members.

🔄 AI Optimization Begins: Fine-tuning AI to improve engagement quality and relevance.

Weset is entering a new era of AI-driven tokenization, cross-chain liquidity, and DeFi expansion. By integrating cutting-edge automation with scalable blockchain infrastructure, Weset is setting new industry standards for RWAs.

Weset is not just participating in the RWA revolution—it’s leading it. With AI automation, DeFi liquidity, and cross-chain integrations, Weset is building a resilient, scalable, and high-impact tokenization ecosystem.

🚀 The future of decentralized finance and tokenized assets starts here.

🛠️ Eligibility Requirements

To qualify for the $WECO airdrop, participants must meet the following criteria:

📌 Required Hashtags (Use at least 2 per tweet)

🎯 Airdrop Amount & Rewards

📢 Snapshot & Distribution

🔎 How We Verify Engagement

⚡ Important Reminders

✔️ Twitter account must be public. ✔️ Spam & fake participation = disqualification. ✔️ Failure to submit the form = no airdrop. ✔️ Complete all steps before the deadline.

🚀 Engage, promote, and secure your rewards!

*As of March 2, 2024. Subject to change.

Virtuals AI Agents

Non Virtuals AI Agents

https://x.com/zoniqxinc

$WECO contract address on Base (Uniswap): 0x99ba92234E0f0f7c2A16Cb087e7307ade19Cab1C

$WECO address on BNB: (PancakeSwap):0x5d37ABAFd5498B0E7af753a2E83bd4F0335AA89F

$WECO page on Virtuals Protocol: https://app.virtuals.io/virtuals/20470

weset rwa marketplace and infrastructure: weset.app

Blog: https://weset.io/revolutionizing-real-world-assets-weset-expands-with-ai-and-virtuals-protocol/

Weset and Chainlink CCIP blog: https://weset.io/weset-integrates-chainlink-ccip-to-enable-secure-cross-chain-transfers-of-weco/

Weset in Chainlink Ecosystem (official alliance): https://www.chainlinkecosystem.com/ecosystem/weset

Original Weset White Paper: https://weset.io/whitepaper/

$WECO and Weset official Telegram: @WecoinDiscussionGroup

$WECO and Weset on X: https://x.com/WESET_io

Suscríbete a nuestra Newsletter

Síguenos

Contáctanos

Intechko Corporation S.A. de C.V. entidad regulada por BCR y por la Superintendencia del sistema Financiero de El Salvador. Para consultas o quejas no resueltas contactar a atenció[email protected]