Caution Regarding Forward-looking Statements

This whitepaper contains forward-looking statements or information (collectively “forward-looking statements”) that relate to Weset’s current expectations and views of future events. In some cases, these forward-looking statements can be identified by words or phrases such as “may”, “will”, “expect”, “anticipate”, “aim”, “estimate”, “intend”, “plan”, “seek”, “believe”, “potential”, “continue”, “is/are likely to” or the negative of these terms, or other similar expressions intended to identify forward-looking statements.

Weset has based these forward-looking statements on its current expectations and projections about future events and financial trends that it believes may affect its financial condition, results of operations, business strategy, financial needs, or the results of the token sale or the value or price stability of Weset (WECOIN) Tokens.

In addition to statements relating to the matters set out here, this whitepaper contains forward-looking statements related to Weset´s proposed operating model. The model speaks to its objectives only, and is not a forecast, projection or prediction of future results of operations.

Forward-looking statements are based on certain assumptions and analysis made by Weset in light of its experience and perception of historical trends, current conditions and expected future developments and other factors it believes are appropriate and are subject to risks and uncertainties. Although the forward-looking statements contained in this whitepaper are based upon what Weset believes are reasonable assumptions, these risks, uncertainties, assumptions, and other factors could cause Weset’s actual results, performance, achievements, and experience to differ materially from its expectations which are expressed, implied, or perceived in forward-looking statements. Given such risks, prospective participants in this token sale should not place undue reliance on these forward-looking statements.

The Weset White Paper outlines the Weset ecosystem, designed to revolutionize asset tokenization by providing a secure, transparent, trusted, scalable, and customizable platform. Weset empowers asset owners and NFT holders through a comprehensive and innovative range of services and infrastructure. Weset’s native cryptocurrency, $WECO, backed by Real World Assets (RWAs), serves as a core component, offering benefits and possibilities within our ecosystem. Security, trust, and transparency are paramount, ensuring a reliable and user-friendly experience.

Welcome to Weset – Where Real-World Assets Transform into Limitless Opportunities.

Weset is pioneering a groundbreaking platform that unlocks the latent potential of tangible assets through the transformative power of blockchain technology.

The Weset mission is crystal clear: to build a scalable, user-friendly, and legally compliant ecosystem that empowers asset owners across the globe to capture and share the inherent value of any asset.

On the demand/retail side, Weset aims to democratize investment opportunities, making investment or utility in a diverse array of assets, including real estate, vehicles, art, and more, accessible, affordable, liquid, secure, and fully compliant with legal regulations.

The vision revolves around crafting exceptional user experiences that forge enduring investment relationships within the digital economy and the Web3 community. Weset envisions a future where asset owners and their token holders foster thriving, long-term connections that drive growth and prosperity for all. Weset’s robust technological ecosystem will make Weset.app the global leader for tokenized real-world assets (RWA).

Elevating tangible assets into digital tokens through Weset’s cutting-edge platform opens doors to a borderless marketplace. Here, global accessibility and fractional ownership become the norm, setting the stage for unparalleled investment opportunities. Weset prioritizes regulatory compliance, security, and scalability for both asset owners and token holders, while our robust user experience systems inspire confidence, streamline management, and fuel the sustained growth of your investment community. With Weset, you can effortlessly unlock the full value of your assets and cultivate a global community and network of enthusiastic investors.

Within the Weset ecosystem, NFT holders open the door to secure, affordable, and transparent access to a diverse range of global assets. The Weset platform empowers frictionless, cost-effective, and liquid investment options across various asset classes. Weset is at the forefront of shaping regulatory developments in tokenization and digital assets, advocating for the fair recognition of this innovative sector in regional and global regulations.

Weset is proud to announce that it has been honored with the PropTech Latam 2023 award for the best fintech solution application to real estate. This accolade reflects Weset’s commitment to innovation and excellence in the field of asset tokenization. Weset leadership has also successfully completed the Founder Institute accelerator program and the company has received the Bitcoin Services Provider License from the Comisión Nacional de Activos Digitales (CNAD) of El Salvador.

Succesfully completed FI batch Mexico 2023

PropTech Latam 2023 award for best fintech solution application to real estate.

Bitcoin Services Provider license

In the rapidly evolving landscape of real-world asset tokenization, challenges and obstacles often stand in the way of seamless and efficient transactions. In this section, we identify key issues faced by both asset owners and investors and present innovative solutions to these challenges. It’s important to note that Weset’s solutions are discussed in further detail throughout the whitepaper in their corresponding sections, providing a comprehensive understanding of how Weset addresses these critical concerns.

Asset owners are at the forefront of the RWA tokenization movement, but they encounter several challenges on this transformative journey:

Many asset owners find themselves bound by the inherent illiquidity of their investments. Real estate, art, and other tangible assets, while valuable, often tie up significant capital for extended periods. This poses difficulties when owners seek to access funds for other opportunities or emergencies.

Weset’s solution to the challenge of illiquid assets is straightforward: tokenization. By converting real-world assets into digital tokens, asset owners gain liquidity. These tokens can be traded on digital asset marketplaces, enabling owners to access funds quickly and efficiently. When the asset is fractionalized and tokenized, it becomes affordable and accessible to a global online market.

In the traditional world of asset ownership, capital-raising involved a labyrinth of centralized, complicated, and bureaucratic procedures. Asset owners seeking investment had to navigate the complexities of forming legal entities, conducting private placements, complying with securities laws, and managing administrative overhead. This convoluted process often deterred asset owners from unlocking the full potential of their holdings.

Weset’s blockchain-based asset tokenization solution eliminates the need for centralized, complex, and costly capital-raising procedures. Through the Weset platform, asset owners can seamlessly tokenize their holdings, representing ownership as digital tokens on the blockchain. This streamlined approach democratizes access to investment opportunities, breaking down barriers that once hindered capital formation.

Asset owners can now attract investors and raise capital efficiently, without the need for extensive legal documentation, securities compliance, or intermediaries. The blockchain’s transparency and automation provide a secure and auditable way to connect with a global pool of potential investors. Weset’s solution revolutionizes the capital-raising landscape, offering asset owners a more accessible, customizable, and efficient path to funding their ventures.

Asset owners face the challenge of navigating complex legal procedures when considering asset tokenization. These procedures include ensuring compliance with jurisdiction-specific regulations, drafting and executing smart contracts, and securely managing ownership records on the blockchain. The intricacies of these processes can be daunting and time-consuming, potentially discouraging asset owners from fully embracing tokenization.

Weset streamlines the legal compliance process for asset owners by leveraging its Digital Assets Service Provider license issued by the El Salvador National Commission of Digital Assets (The Commission). All asset collections on the Weset platform are launched through our license, ensuring the highest level of regulatory approval. This approval is recognized as one of the most globally advanced and respected in the digital asset regulatory landscape. With the Weset license already in place, asset owners benefit from a simplified tokenization process. Weset requires only basic documentation from the asset owner, as we have already undertaken the complex legal work on behalf of clients. This approach saves time, reduces complexity, and enhances the accessibility of tokenization for asset owners. Detailed legal information is further explored in the dedicated legal section of this White Paper.

Traditional markets for big-ticket and illiquid assets frequently restrict participation to local buyers, limiting asset owners’ ability to tap into broader, global markets. This limitation arises from a lack of familiarity with foreign markets, the intricacies of legal processes, and the opacity of cross-border transactions.

Weset’s blockchain-based platform breaks down geographical barriers. Asset owners can reach a global audience of potential investors, expanding the market for their tokenized assets. The Weset platform provides the infrastructure and support needed to navigate international markets confidently.

Entrusting valuable assets to digital tokens necessitates robust security measures. Asset owners must guard against potential cyber threats, fraud, and unauthorized access to their tokenized assets, making cybersecurity a top priority.

Weset places a strong emphasis on cybersecurity. Weset employs advanced security protocols, encryption, and monitoring to protect digital assets. Weset’s comprehensive security measures ensure that tokenized assets remain safe and secure, providing asset owners with peace of mind.

Conventional asset transactions come with significant expenses, including legal fees, administrative costs, and intermediary charges. These financial burdens can erode an owner’s returns and act as a deterrent to participation in tokenization.

Weset’s blockchain tokenization process significantly reduces transaction costs. By eliminating intermediaries and automating many processes, Weset make asset tokenization more cost-effective for owners. This enhances the overall return on investment for asset owners.

Many asset owners lack the knowledge and resources required to navigate the tokenization process effectively. They face challenges in understanding the intricacies of blockchain technology, ensuring legal compliance, and building a sustainable community of token holders.

Weset offers expert guidance and support throughout the tokenization journey. Our team assists asset owners in every step, from initial consultation to regulatory compliance and community-building. Weset provides the knowledge and resources needed to succeed in the world of asset tokenization.

Once an asset has been tokenized, the asset owner and the NFT holder have entered into long-term partnership. Without adequate web3 infrastructure to manage payouts and information, the user experience will suffer and the community may lose support for the project.

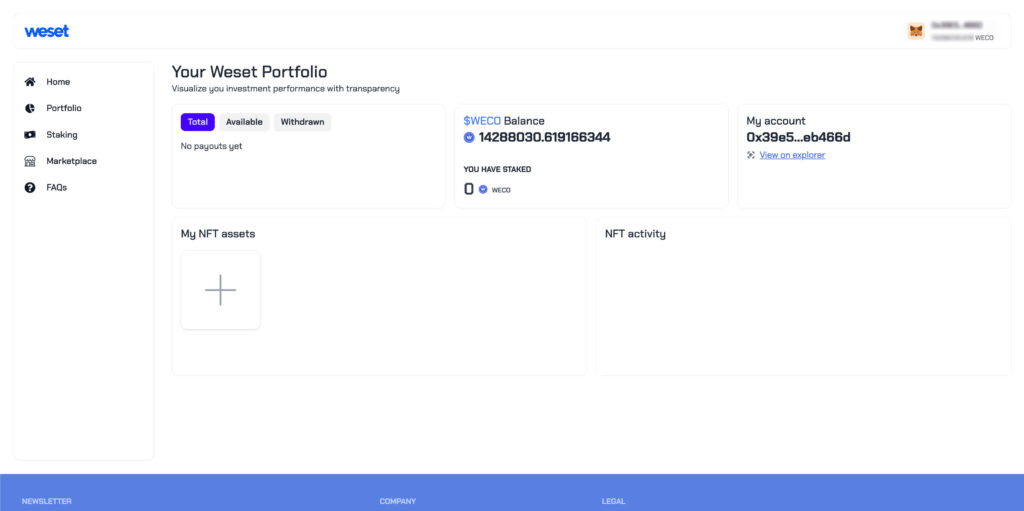

We saved the best solution for last. When assets are tokenized on the Weset platform, the asset owner and the NFT holders are both supported by robust and reliable dashboard infrastructure. This web3 infrastructure is customizable and allows asset owners to easily receive data on their project and easily communicate and share payouts with their community in order to ensure long-term success.

Token holders can easily login with web2 or web3. The dashboard allows them to manage and withdraw payouts, see their holdings, and clearly understand data on their investments. We recommend you demo this on weset.app.

Investors who look for exposure to RWAs either through legacy structures or tokenization encounter their unique set of challenges:

Potential investors often encounter entry barriers into the world of RWA. High minimum investment requirements, complex user interfaces, bureaucracy, and unfamiliarity with blockchain technology can make participation in RWA markets challenging.

Weset’s platform is designed with accessibility in mind. The platform offers user-friendly interfaces that make it easy for investors, regardless of their level of blockchain knowledge, to participate. Additionally, the Weset platform allows fractional ownership, reducing the barrier of high minimum investment requirements.

Informed investment decisions hinge on transparent and accurate asset information. However, RWA investors frequently face gaps in data, making it challenging to assess the true value and performance of tokenized assets accurately.

Weset’s blockchain-based platform enhances transparency. Investors have access to comprehensive information about tokenized assets, including their origin and associated metadata. This transparency empowers investors to make informed decisions. In addition to Weset’s transparency initiatives, third parties are invited to investigate all the public information on the blockchain and produce valuable market data.

Fragmentation within the tokenization ecosystem creates isolated markets for different asset classes. This lack of interoperability hinders diversification opportunities for RWA investors, limiting their ability to construct balanced portfolios.

Weset promotes interoperability within the tokenization ecosystem. The Weset platform connects diverse asset classes, providing investors with opportunities for diversification. The Weset marketplace will provide a constantly-growing option of RWA tokens for primary and secondary market sales.

Liquidity issues plague some tokenized assets, resulting in difficulties when RWA investors wish to buy or sell their investments. These liquidity constraints can lead to extended holding periods and impede portfolio management.

Weset works to enhance liquidity for tokenized assets. Through the Weset platform, investors can access a liquid secondary market, allowing them to buy or sell their investments quickly and efficiently. This ensures that liquidity challenges do not hinder portfolio management. An automated market maker will further increase liquidity.

Weset’s technology and infrastructure form the bedrock of our mission to create a secure, transparent, and trusted ecosystem for RWA tokenization. Weset has carefully designed and integrated cutting-edge technologies and blockchain networks to provide a seamless experience for asset owners and investors.

Weset operates on the Polygon network, a blockchain renowned for its scalability, interoperability, and low transaction costs. This choice of blockchain aligns with Weset’s commitment to delivering efficient and cost-effective solutions to our clients. Polygon’s compatibility with Ethereum ensures that the platform seamlessly integrates with popular Ethereum-based tools and technologies, enhancing its versatility.

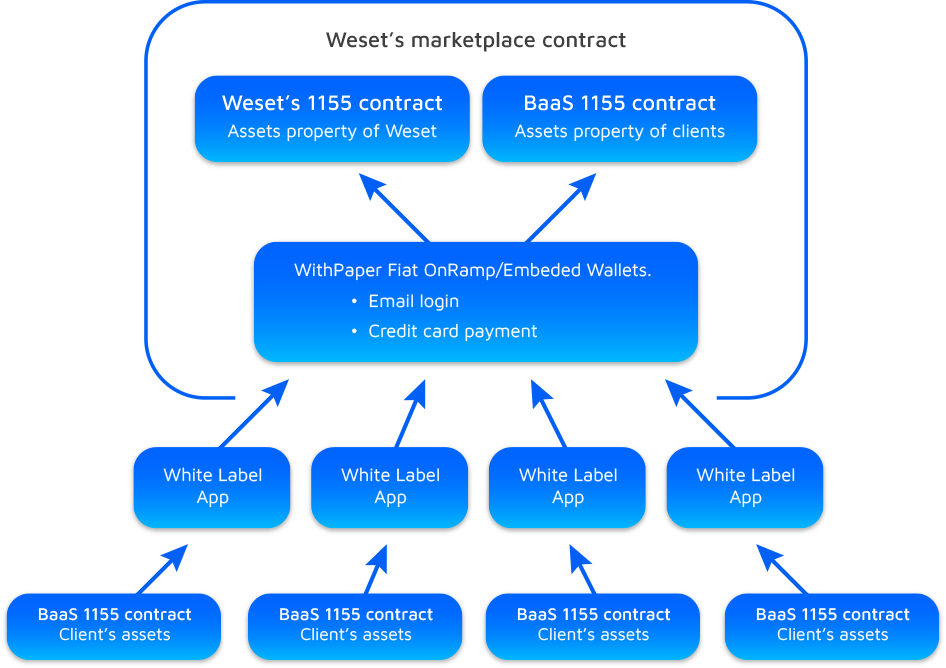

The Weset platform’s core functionality relies on the power of smart contracts, specifically ERC-1155, which serves as the foundation for asset tokenization. These smart contracts govern the creation, management, and transfer of digital assets representing real-world ownership, ensuring the security and integrity of every transaction within the ecosystem.

At the heart of Weset’s technology stack lies “WithPaper,” a user-friendly solution designed to simplify the onboarding process and facilitate payment processing. WithPaper offers the following key components:

Blockchain technology serves as the cornerstone of Weset’s commitment to security, transparency, and trust. Here’s how blockchain ensures these vital aspects of the tokenization process:

The diagram above demonstrates how all the pieces come together to form the Weset ecosystem. BaaS 1155 contracts are created for all clients, producing unique collections tailored to each asset owner’s tokenomics. These collections are seamlessly connected to WithPaper, which provides smart contract deployment and management, web2 logins (custodial wallet generation), and credit card processing. This integration enables the minting of NFTs through credit card transactions, expanding accessibility and convenience. Additionally, 0xSplits is utilized to promote accountability and transparency for payouts, while Superfluid is poised to enhance advanced payouts and collateral management. Within Weset.app, two marketplace contracts operate: Weset.app contracts for Weset 1155 assets and BaaS 1155 contracts for client contracts. These marketplace contracts correspond to the BaaS contracts at the bottom, serving as representations. All assets are available for purchase on the weset.app marketplace and within custom pages dedicated to each client.

In summary, Weset’s technology and infrastructure are meticulously crafted to provide a secure, transparent, and trusted ecosystem for real-world asset tokenization. Through Weset’s strategic integration with the Polygon network and WithPaper, asset owners, investors, and users are empowered to confidently participate in the digital fractional economy at a global scale.

Weset’s mission is to empower both asset owners and NFT holders within the digital asset ecosystem. Weset provides a diverse range of services and offerings tailored to the unique needs and perspectives of these two key stakeholders. Weset’s commitment to excellence, scalability, and innovation drives our vision for a more inclusive and accessible digital economy.

At the core of Weset’s services for asset owners is the art of customization. Weset creates custom Web3 pages and collections that align with our clients’ branding and specific requirements. These unique digital showcases breathe new life into traditional assets, making them more visible and appealing to a global audience.

Weset’s custom Web3 pages and collections carry your branding, establishing a distinct online presence aligned with your vision.

Weset prioritize use and community engagement, crafting immersive and interactive experiences to captivate audiences and generate interest in tokenized assets.

Beyond tokenization, Weset offers custom dashboard solutions that empower token issuers to manage relationships, communications, and payouts with their valued token holders. These dashboards serve as a vital bridge between asset owners and their communities, fostering trust, engagement, and long-term success.

Weset’s Web3 pages and collections transcend geographical boundaries, extending the reach of your assets to a diverse pool of potential investors.

Within the Weset ecosystem, the platform provides a dedicated marketplace where tokenized assets, including those created on our platform and custom Web3 pages, are made available to a global audience. This marketplace enhances asset visibility and accessibility, making it a pivotal component of the digital asset journey.

The marketplace introduces liquidity to asset owners, allowing them to access capital while retaining ownership, facilitating flexibility in financial decisions.

Weset’s inclusive approach extends to both Web2 and Web3 users, ensuring that everyone, regardless of their familiarity with cryptocurrency, can participate in the asset tokenization ecosystem. The Weset platform offers multiple login options, including email login for Web2 users and Web3 login through WithPaper for crypto enthusiasts, supporting various wallets. This bridges the gap between traditional and blockchain-based finance, catering to a wide spectrum of users.

Weset provides clients with the flexibility to create utility tokens, passive income tokens, equity tokens, or hybrid combinations thereof, aligning with their unique business objectives and engagement strategies.

As Weset collaborates with an array of clients, we accumulate a portfolio of templates, custom frameworks, and Web3 pages. This catalog of resources enhances scalability for future projects, expediting the creation of custom collections and Web3 pages for new clients. As Weset builds out the user experience, we will capture the value added and exponentially accelerate its potential through automation and AI.

Through these comprehensive service offerings, Weset empowers asset owners to embark on a transformative journey into the world of digital assets, providing the tools and support needed to navigate the digital economy with confidence and success.

NFT holders play a pivotal role in the Weset ecosystem, benefiting from the services and offerings in various ways:

NFT holders gain access to a diverse marketplace featuring a wide range of tokenized assets, including real estate, art, vehicles, and more. This enables them to explore unique investment opportunities and diversify their portfolios.

Weset ensures secure and transparent transactions for NFT holders by leveraging blockchain technology. Every transaction is recorded on a public ledger, providing verifiable ownership and transaction history.

Weset ensures secure and transparent transactions for NFT holders by leveraging blockchain technology. Every transaction is recorded on a public ledger, providing verifiable ownership and transaction history.

Weset prioritizes user experience for NFT holders, offering intuitive interfaces and interactive features within the marketplace. This enhances the overall engagement and satisfaction.

NFT holders have the opportunity to invest in assets from around the world, breaking down geographical barriers and expanding their investment horizons.

By considering the perspectives of both asset owners and NFT holders, Weset creates a thriving ecosystem that benefits all participants, fostering innovation, accessibility, and inclusivity within the digital asset space.

Custom pages and collections for clients

$15K-$20K

Build inventory of templates

1% commissions for sales on client page + Weset marketplace

$200 per month, per collection, for client and token-holder

dashboards

→ 10% of profits returned to token holders.

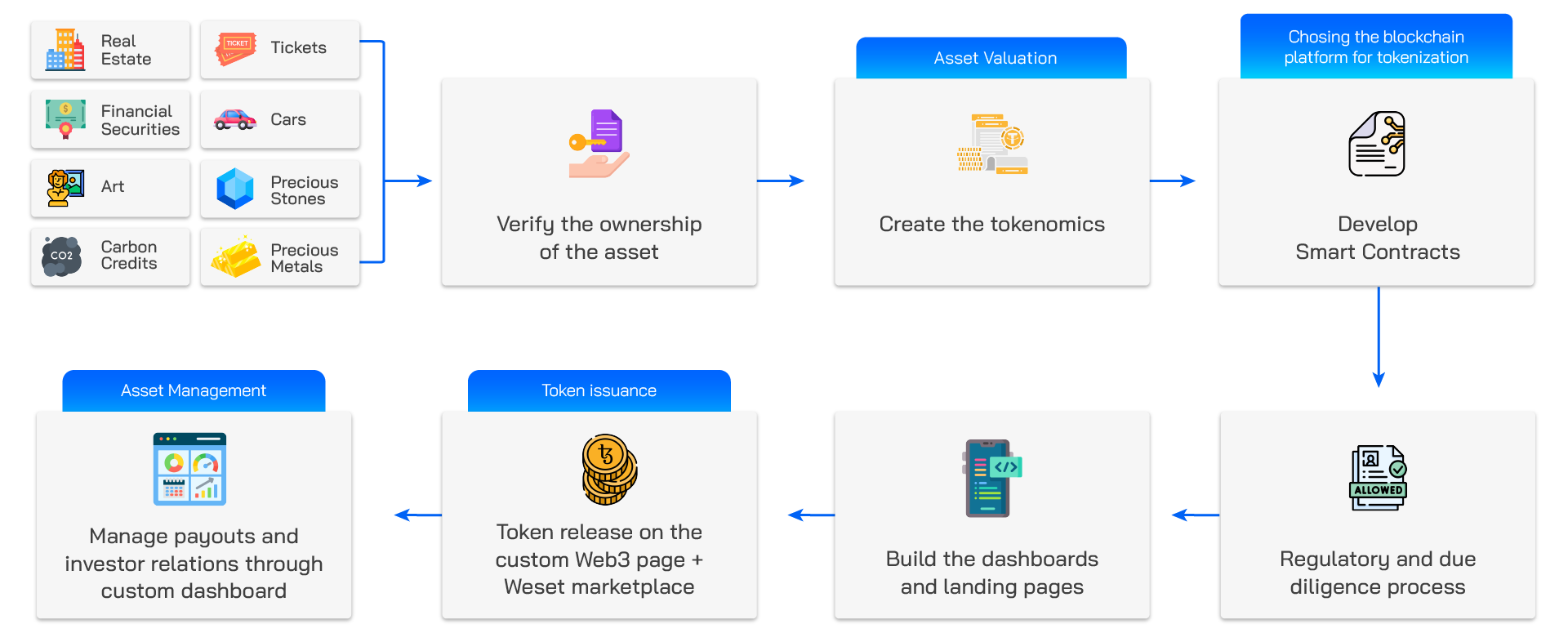

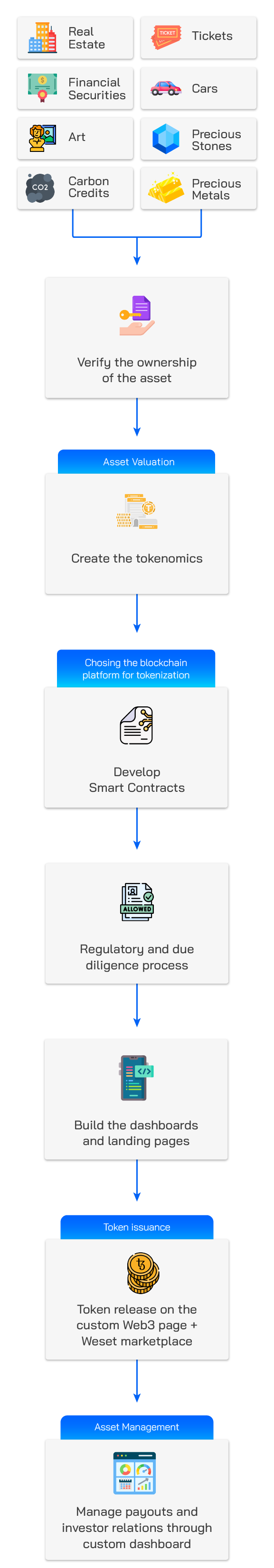

Weset is pioneering the seamless transition of tangible assets into digital tokens, opening new frontiers for asset owners to unlock the full potential of their holdings. Weset’s comprehensive asset tokenization process is designed to empower asset owners while ensuring regulatory compliance and security at every step. Below is an overview of the Weset asset tokenization journey:

Through this efficiently structured and technically sound asset tokenization process, Weset empowers asset owners to transform their illiquid holdings into liquid digital assets, providing investors with opportunities for diversification and unique opportunities. Regulatory compliance, transparency, and a robust legal framework are foundational elements that instill trust in the asset tokenization ecosystem. Following this process ensures a quality product that generates value for asset owners and their communities for decades.

Weset is committed to maintaining the highest standards of legal and regulatory compliance in the tokenization of real-world assets. Weset has taken significant steps to ensure that our clients and token holders benefit from a secure and compliant environment.

A variety of partners and integrations can be used to ensure that the tokenized asset and its owners have been thoroughly vetted and KYCd.

With the assurance of regulatory compliance and legitimacy, asset owners can confidently embark on their tokenization journey, navigating each stage with Weset’s expert guidance:

Certainly, with the additional background information, here are the paragraphs for the legal section:

In addition to Weset’s Digital Assets Service Provider license, we proudly holds the esteemed status of a Bitcoin Services Provider under El Salvador’s groundbreaking Bitcoin Law. This dual recognition further reinforces Weset’s commitment to managing cryptocurrency responsibly and within the bounds of the law on behalf of our clients. The Bitcoin Law imposes new financial compliance regulations on Bitcoin service providers, which reflect those applicable to traditional financial institutions. These regulations include stringent anti-money laundering and counter-terrorism financing measures, cybersecurity protocols, client asset protection, and comprehensive record-keeping. Weset’s status as a Bitcoin Services Provider signifies our unwavering dedication to upholding the highest standards of financial compliance and security in the realm of cryptocurrency.

By combining the Digital Assets Service Provider license and Bitcoin Services Provider status, Weset establishes itself as a paragon of security and compliance within the digital asset realm. These dual licenses exemplify Weset’s unwavering dedication to becoming global leaders in regulatory compliance, particularly in the burgeoning realm of RWA tokenization. Weset’s clients can rest assured that their assets are managed under the most stringent legal and regulatory standards, fostering trust, credibility, and a truly global reach. As Weset navigates the dynamic landscape of cryptocurrency in El Salvador, we remain committed to providing a secure, compliant, and globally accessible sandbox for asset owners to unearth the boundless value of their real-world assets.

At the core of the Weset ecosystem lies Wecoin ($WECO), a versatile and multifunctional cryptocurrency token meticulously designed to enhance and enrich the experiences of users and stakeholders alike. More than just a digital currency, $WECO serves as a pivotal component within the Weset comprehensive ecosystem.

What sets $WECO apart is its ultimate backing by RWAs. As participants engage with the Weset platform, they gain access to a diverse range of tangible assets. These RWAs not only enhance the utility of $WECO but also provide intrinsic value, making it a digital token rooted in the physical world.

Investing in $WECO isn’t just about owning a cryptocurrency; it’s akin to holding shares in a dynamic digital ecosystem. Weset proudly shares 10% of its profits with its valued $WECO holders, effectively transforming the token into a digital stock that pays dividends. Participation in Weset represents not only an investment in the future but also a direct path to reaping the rewards of collective achievements.

As we look ahead, the potential applications of $WECO within the Weset ecosystem are vast and continuously evolving. Some of the exciting possibilities on the horizon include:

$WECO operates on the Binance Smart Chain (BSC) and is traded on Pancake Swap, a decentralized exchange. Security and transparency are paramount, and to underline Weset’s commitment to these principles, $WECO has undergone a rigorous audit conducted by Certik, an industry leader in blockchain security. The audit has garnered impressive scores, reinforcing the trustworthiness of $WECO. https://skynet.certik.com/projects/weset-io

In line with Weset’s commitment to responsible growth, from time to time, Weset may strategically utilize some holdings to fund project development and further advance the Weset ecosystem. $WECO is a long-term asset, standing as a testament to Weset’s dedication to building a secure, sustainable, and value-driven environment.

Weset’s commitment to building a secure and trustworthy ecosystem ensures that users can engage with confidence, knowing their assets and investments are protected.

Weset prioritizes the safety of our users and their digital assets. To achieve this, Weset employs a multi-faceted approach to cybersecurity and risk management:

The Weset platform utilizes advanced blockchain scanning tools and services that continuously monitor and analyze on-chain activities in real-time. These scanners are seamlessly integrated into Weset’s infrastructure, allowing us to closely track transactions, smart contract interactions, and token movements. By doing so, Weset can proactively detect unusual patterns, anomalies, or potential security threats within the blockchain.

To maintain the integrity of our frontend and backend components, Weset has partnered with Vercel, a leading hosting service that proactively identifies issues in deployed components. Vercel provides us with detailed error logs and notifications, enabling swift responses and troubleshooting of any potential problems.

In the realm of Web3, security takes on a unique dimension. While blockchain technology itself presents inherent security advantages, the focus of Weset shifts to mitigating social hacking risks, including fake accounts, groups, phishing, and fraudulent airdrops.

We understand that transparency is paramount in building trust within the digital asset ecosystem. Weset is committed to providing a transparent and accountable environment for all participants:

Weset is dedicated to providing users with accurate and unbiased information:

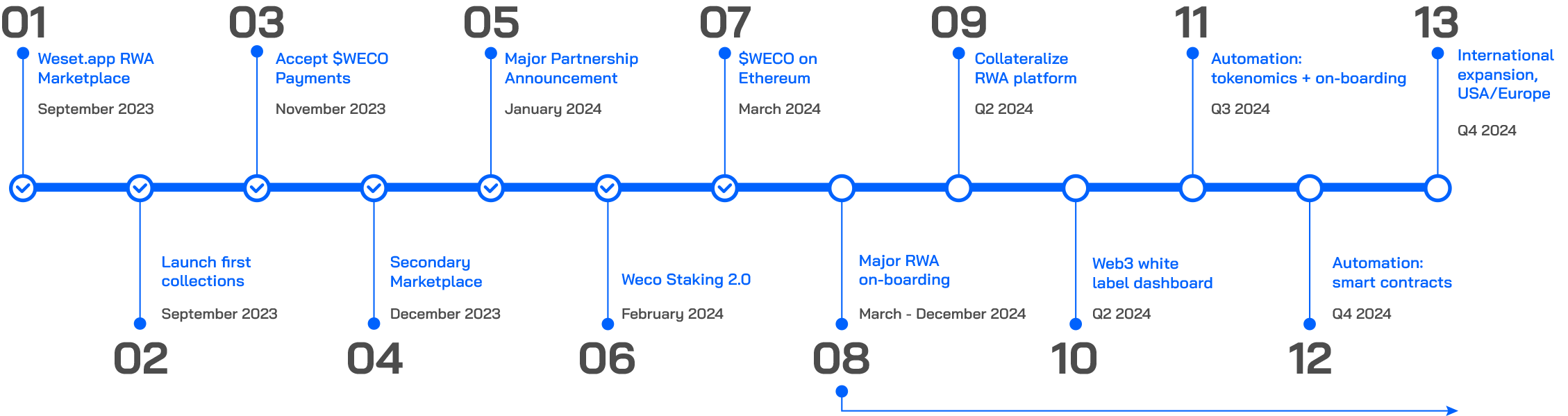

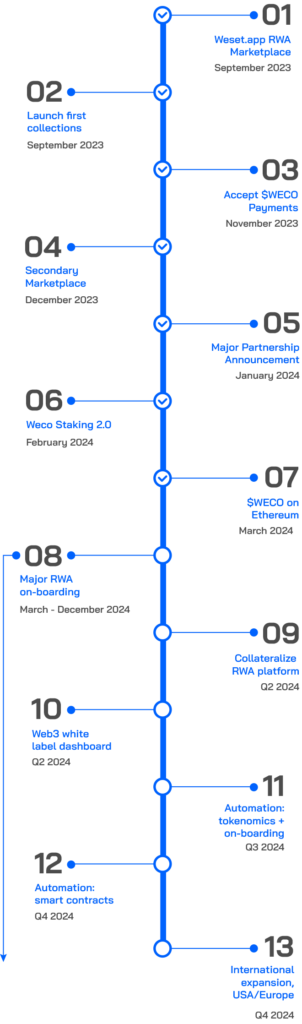

The Weset journey towards a more scalable, transparent, and liquid ecosystem is driven by our steadfast commitment to our valued stakeholders. It’s the $WECO holders, NFT owners, and asset owner who hold the key to unlocking our shared future vision. As active participants and shareholders, their influence extends far beyond transactions. Together, we envision a future where technology empowers asset owners and investors with unprecedented efficiency and trust. Here are some areas that Weset has identified as key drivers for a continuously thriving ecosystem:

Today, our approach involves hands-on creation of web3 sites and collections and collaborative business planning with clients. However, we are committed to achieving scalability through Artificial Intelligence (AI). Once our suite of templates and successful collections is established, we’ll employ AI to make the tokenization process as straightforward as becoming an Airbnb host. AI will actively engage with asset owners to tailor the ideal tokenization model, incorporating their business strategy, objectives, and community requirements. Smart contracts will be infused with AI, and AI templates will construct web pages. Our platform will also guide asset owners through application processes with regulatory authorities, automating the entire journey by adapting to the unique nature of their assets, tokenization models, geographic location, and the documents required.

Oracles are pivotal in Weset’s journey towards a more transparent ecosystem. These trusted data sources have a multifaceted role in ensuring accountability and fostering investor confidence. Beyond verifying proof of reserves, oracles offer various applications:

Oracles verify revenue, asset valuations, and regulatory compliance, aligning reported data with reliable sources. They also provide insights into asset performance metrics, environmental and social impact, and real-time market analytics. These applications collectively contribute to increased transparency, trust, and accountability, strengthening our commitment to a secure and credible asset tokenization environment.

As we expand our collection and network, liquidity will flourish. This organic growth benefits both Weset and our community members through the network effect. To maximize options, we aim to provide various avenues for buying and selling, such as automated market makers, peer-to-peer sales, and auctions. The possibilities are limitless, giving every participant the flexibility to engage with our platform in a way that suits their unique needs.

Upholding the highest standards of compliance and regulation on a global scale is integral to our future vision. Weset aspires to be a trailblazer in navigating the complex legal landscape. By proactively embracing international regulatory standards, we intend to set a precedent for trust and credibility not only within Weset but across the entire tokenization industry.

Our future vision encompasses building an ecosystem that empowers asset owners, investors, and communities. We invite you to be part of this journey into a future where innovation knows no bounds and the blockchain revolutionizes real-world asset tokenization.

Suscríbete a nuestra Newsletter

Síguenos

Contat us

Intechko Corporation S.A. de C.V. entidad regulada por BCR y por la Superintendencia del sistema Financiero de El Salvador. Para consultas o quejas no resueltas contactar a atenció[email protected]